www.buildingsandcities.org/insights/commentaries/cop26-planning.html

Adapt or Retreat? Developing a Long-Term Regional Planning Strategy

By Ellen van Bueren (Delft University of Technology, NL)

The delegates at COP-26 should now fully direct their attention to creating agreements and action plans. This creates a momentum to start planning our urban futures with a long-term perspective, in tune with the changing climate. The emphasis on adaptation is not always an appropriate option as it has unintended consequences which compound risks and can lead to a downward spiral of neighbourhoods and cities. A public debate is needed to develop clarity on when and where adaptation or managed retreat are appropriate. We need to ask: how can city regions develop in a resilient way, what assets should be preserved, at what costs and how do we protect vulnerable citizens?

Climate mitigation and adaptation strategies thus far have focused on improving and adapting buildings and cities as they are (Andrić et al., 2019). Even though these actions were considered to contribute to climate resilience, the opposite might be true in the long run. Current strategies have, for example, led to investments in buildings, public spaces, and infrastructures in cities, aiming to contribute to goals as the reduction of the carbon footprint and adapt to the changing climate (e.g. increase water buffering capacities, reduce flooding, reduce overheating). Much attention is paid by governments to the upscaling and speeding-up of the transformation of our current building stock into a (net-)zero-emission stock that is prepared for the future. These efforts come with large investments, often with long pay-back times. This may seem a logical strategy to follow as it affects a society's homes or businesses. In the short run, this will indeed improve buildings and cities, and from an investment point of view, this strategy makes sense too: assets at risk or damaged have financial and economic value that are worthwhile to protect. Also, in the aftermath of hazards, and in the anticipation of hazards, a dominant human reaction is to repair and 'build back better'; to rebuild and reinforce and improve buildings and infrastructures with protective measures which improve their resistance and resilience (e.g. Maly, 2018). In this way, the asset value of our buildings and cities is safeguarded, as well as the other more intangible values of housing and city life.

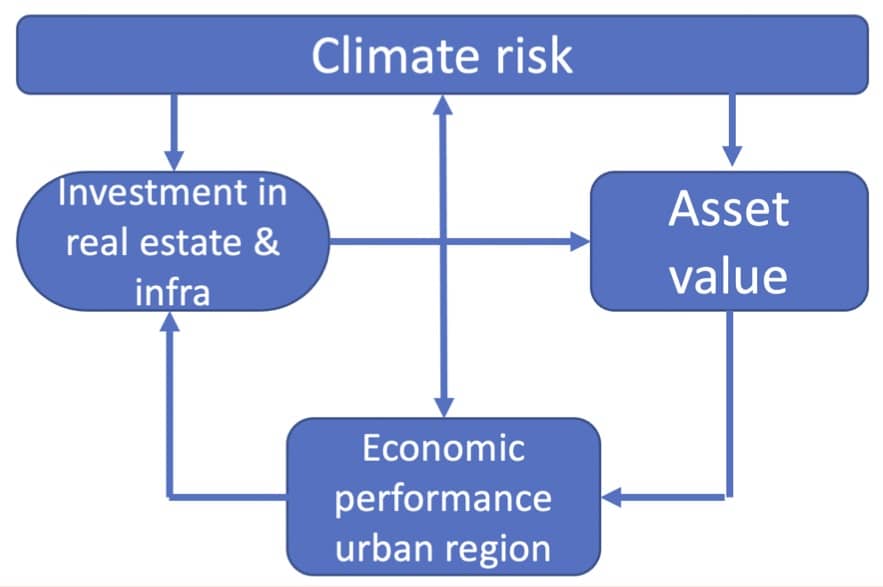

However, from a longer-term perspective, 30-100 years, these investments become questionable (Knuth, 2019). Investments in climate adaptation and mitigation in our buildings and cities will lead to a higher value of these assets, which in turn attracts investment, as shown by city regions' continued urbanization and densification, which, in turn, support the value increase. The higher value also incentivizes asset owners and managers to invest in the protection of the assets even further (Burgess & Rapoport, 2019). What this upward spiral of investment and value accumulation may lead to can be witnessed in Florida, where building back better is a key strategy of survival irrespective of the increased and compounding climate risks in particular regions and places (Taylor, 2020). When climate effects materialize, for example, in falling housing prices and increasing insurance premiums, the asset value will start spiralling downwards, with similar reinforcing feedback mechanisms that led to the value accumulation in these areas (Keenan et al., 2018). At first, this may lead to loss of asset value, and gradually trigger the decline of neighbourhoods and districts. Eventually, this leads to the weakening of city regions that are no longer considered competitive (cf. Catalano et al., 2019). Such a downward spiral will know many losers, and only some winners. Those without a choice to relocate themselves and their belongings will suffer the most and face climatic consequences. The relationships between climate risk, real estate investment, asset value and economic performance of an urban region are presented in a simplified model in Figure 1.

To prevent such scenarios from happening, COP-26 provides the perfect setting to start the global debate on climate risk management strategies from an urban and regional planning point of view. Given the longevity of real estate and infrastructure and given the accumulative value effects of real estate investment, it is essential that we start preparing for this changing climate beyond the level of buildings and districts, and even beyond the city level.

Real estate investors and large asset managers have already started to consider climate risk in their investment strategies, securing their returns by investing in cities and regions that are less at risk (Burgess et al., 2020). Also, the European banks and insurers are rapidly developing climate risk norms for real estate finance. A one-sided acceleration of such climate risk concerns by the real estate finance sector may trigger the downward asset value in our main economic city regions, with global investors securing their funds in the lower risk regions (Taylor, 2020).

COP-26 would be the perfect agenda-setting stage for starting this long-term oriented planning debate. This should start a wide public debate on which assets and areas are worthwhile protecting, how such plans will influence the interests and livelihoods of groups of people and organisations, and how future city regions could develop in a resilient way, to sustain cities and city regions as places of tangible and intangible values. The real estate finance sector, now taking the lead in the retreat, should be quickly joined by governments, spatial planners, water managers and NGOs (non-governmental organisations) to fill the blind spots of the private sector actions (Goldstein et al., 2018) and to make it a 'managed retreat' (Kelman, 2020).

A managed retreat involves a multi-decadal sequence of actions across sectors and levels and should include community engagement, vulnerability assessment, land use planning, active retreat, compensation, and repurposing (Haasnoot et al., 2021). The preparation and management of the retreat, or, framed more positively, the adaptation pathways, should be held at multiple levels: at the level of global investment markets and supranational bodies as well as at national governmental levels and regional and local planning arenas. The representation of vulnerable groups of citizens in these debates will be precarious and steps are needed to ensure their voices and needs are addressed as a matter of urgency. This group of people is most likely to be the first to suffer the consequences of climate change. The outcomes of any actions following from such debates and long-term plans must provide short- and long-term solutions for those who are most vulnerable to climate change impacts.

References

Andrić, I., Koc, M., & Al-Ghamdi, S. G. (2019). A review of climate change implications for built environment: Impacts, mitigation measures and associated challenges in developed and developing countries. Journal of Cleaner Production, 211, 83-102.

Burgess, K., Grayson, B., Foster, E., Carpenter, A., Ludgin, M., Craft, L., Watkins, N., Rollins, J., Churchill, L., Webb, C., McDonald, B. & Maher, C. (2020). Climate Risk and Real Estate: Emerging Practices for Market Assessment. Washington, D.C.: Urban Land Institute.

Burgess, K. & Rapoport, E. (2019).Climate Risk and Real Estate Investment Decision-Making. Washington, DC: Urban Land Institute.

Catalano, M., Forni, L. & Pezzolla, E. (2020). Climate-change adaptation: the role of fiscal policy. Resource and Energy Economics, 59, 101111.

Goldstein, A., Turner, W. R., Gladstone, J. & Hole, D. G. (2019). The private sector's climate change risk and adaptation blind spots. Nature Climate Change, 9(1), 18-25.

Haasnoot, M., Lawrence, J. & Magnan, A. K. (2021). Pathways to coastal retreat. Science, 372(6548), 1287-1290.

Keenan, J., Hill, T. & Gumber, A. (2018). Climate gentrification: From theory to empiricism in Miami-Dade County, Florida. Environmental Research Letters 13: 5.

Kelman, I. (2020). Disaster by Choice: How our Actions turn Natural Hazards into Catastrophes . Oxford University Press.

Knuth, S. (2019). Cities and planetary repair: The problem with climate retrofitting. Environment and Planning A: Economy and Space, 51(2), 487-504.

Maly, E. (2018). Building back better with people centered housing recovery. International Journal of Disaster Risk Reduction, 29, 84-93.

Taylor, Z. J. (2020). The real estate risk fix: Residential insurance-linked securitization in the Florida metropolis. Environment and Planning A: Economy and Space, 52(6), 1131-1149.

Latest Peer-Reviewed Journal Content

Living labs as ‘agents for change’ [editorial]

N Antaki, D Petrescu & V Marin

Post-disaster reconstruction: infill housing prototypes for Kathmandu

J Bolchover & K Mundle

Urban verticalisation: typologies of high-rise development in Santiago

D Moreno-Alba, C Marmolejo-Duarte, M Vicuña del Río & C Aguirre-Núñez

A public theatre as a living lab to create resilience

A Apostu & M Drăghici

Reconstruction in post-war Rome: transnational flows and national identity

J Jiang

Reframing disaster recovery through spatial justice: an integrated framework

M A Gasseloğlu & J E Gonçalves

Tracking energy signatures of British homes from 2020 to 2025

C Hanmer, J Few, F Hollick, S Elam & T Oreszczyn

Spatial (in)justice shaping the home as a space of work

D Milián Bernal, J Laitinen, H Shevchenko, O Ivanova, S Pelsmakers & E Nisonen

Working at home: tactics to reappropriate the home

D Milián Bernal, S Pelsmakers, E Nisonen & J Vanhatalo

Living labs and building testing labs: enabling climate change adaptation

J Hugo & M Farhadian

Energy sufficiency, space temperature and public policy

J Morley

Living labs: a systematic review of success parameters and outcomes

J M Müller

Towards a universal framework for heat pump monitoring at scale

J Crawley, L Domoney, A O’Donovan, J Wingfield, C Dinu, O Kinnane, P O’Sullivan

Living knowledge labs: creating community and inclusive nature-based solutions

J L Fernández-Pacheco Sáez, I Rasskin-Gutman, N Martín-Bermúdez, A Pérez-Del-Campo

A living lab approach to co-designing climate adaptation strategies

M K Barati & S Bankaru-Swamy

Mediation roles and ecologies within resilience-focused urban living labs

N Antaki, D Petrescu, M Schalk, E Brandao, D Calciu & V Marin

Negotiating expertise in Nepal’s post-earthquake disaster reconstruction

K Rankin, M Suji, B Pandey, J Baniya, D V Hirslund, B Limbu, N Rawal & S Shneiderman

Designing for pro-environmental behaviour change: the aspiration–reality gap

J Simpson & J Uttley

Lifetimes of demolished buildings in US and European cities

J Berglund-Brown, I Dobie, J Hewitt, C De Wolf & J Ochsendorf

Expanding the framework of urban living labs using grassroots methods

T Ahmed, I Delsante & L Migliavacca

Youth engagement in urban living labs: tools, methods and pedagogies

N Charalambous, C Panayi, C Mady, T Augustinčić & D Berc

Co-creating urban transformation: a stakeholder analysis for Germany’s heat transition

P Heger, C Bieber, M Hendawy & A Shooshtari

Placemaking living lab: creating resilient social and spatial infrastructures

M Dodd, N Madabhushi & R Lees

Church pipe organs: historical tuning records as indoor environmental evidence

B Bingley, A Knight & Y Xing

A framework for 1.5°C-aligned GHG budgets in architecture

G Betti, I Spaar, D Bachmann, A Jerosch-Herold, E Kühner, R Yang, K Avhad & S Sinning

Net zero retrofit of the building stock [editorial]

D Godoy-Shimizu & P Steadman

Co-learning in living labs: nurturing civic agency and resilience

A Belfield

Join Our Community

The most important part of any journal is our people – readers, authors, reviewers, editorial board members and editors. You are cordially invited to join our community by joining our mailing list. We send out occasional emails about the journal – calls for papers, special issues, events and more.

We will not share your email with third parties. Read more

Latest Commentaries

COP30 Report

Matti Kuittinen (Aalto University) reflects on his experience of attending the 2025 UN Conference of the Parties in Belém, Brazil. The roadmaps and commitments failed to deliver the objectives of the 2025 Paris Agreement. However, 2 countries - Japan and Senegal - announced they are creating roadmaps to decarbonise their buildings. An international group of government ministers put housing on the agenda - specifying the need for reduced carbon and energy use along with affordability, quality and climate resilience.

Building-Related Research: New Context, New Challenges

Raymond J. Cole (University of British Columbia) reflects on the key challenges raised in the 34 commissioned essays for Buildings & Cities 5th anniversary. Not only are key research issues identified, but the consequences of changing contexts for conducting research and tailoring its influence on society are highlighted as key areas of action.